If you talk to any mainstream financial planner, you will quickly discover that gold is a contradiction and paradox. Mainstream people will often refer to gold as a barbarous relic. They often disparage the metal as simply being a rock.

Central Banks and the Purchasing Power of Gold

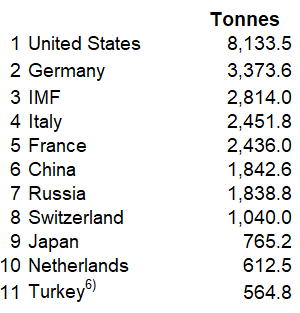

But here is where we would challenge you to think for yourself and simply evaluate some key facts and figures. The following table is a listing of the largest nations’ central banks in the world and how much gold they actually hold. As you review this list, please keep in mind that these institutions are the leading hoarders of gold. Yet in spite of the fact that they hold thousands of tons of the precious metal, and they buy enormous quantities of the precious metal every year, they never miss an opportunity to promote paper currencies and disparage gold. It is truly one of the most entertaining shows on planet earth.

list of top banks buying gold to fight inflation. The very institutions which chastise the yellow metal continue to purchase record quantities of it every year.

These same central banks control the monetary printing press. They print billions or trillions of new money every year and make it mandatory for their paper money (fiat) to be accepted as payments for all transactions public and private.

Fiat Currency Debasement is a Trend

Fiat currency is a currency that is not backed by a physical commodity, such as gold or silver, but rather by the faith and credit of the government. Fiat currencies are also often referred to as paper money or debased coinage. The fiat currency system was first introduced in medieval China, and later spread to other parts of the world. The primary advantage of fiat currency is that it can be easily created, which allows governments to print money when needed. However, this ease of creation can also lead to problems, such as inflation or hyperinflation.

More importantly, the track record of fiat currencies is almost 100% failure. As difficult as that fact is to believe all fiat currencies fail. The average lifespan of a fiat currency is roughly 50 years. There are small exceptions to this rule, but the reality is that all paper currencies are traditionally debased until they lose all of their value.

For example, the British Pound Sterling is the oldest fiat currency. It was founded in 1694. Even though it has survived 328 years, it has lost 99.5% of its original purchasing power. Originally, the British Pound was defined as 12 ounces of silver which would be worth roughly $240 today. The current price on the foreign exchange markets for British Pound Sterling is $1.22. That represents a debasement of 99.492%.

Defenders of this practice are supporters of big government who believe that this debasement was necessary because the government was promoting the “greater good.” My suggestion is to do your own research and draw your own conclusions. Whenever you study monetary history, the story is always the same. The monetary authorities debase the currency to pay for the debts of the kingdom and then they only have two choices:

Make the citizens pay the bill. Or debase the currency by inflating the amount of currency in circulation. Solution #1 causes revolutions so the only politically feasible solution is currency debasement.

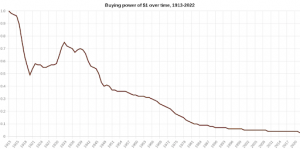

The Loss of a Purchasing Power by US Dollar Since the Creation of Federal Reserve

You will find this footprint across all countries which adopt a fiat currency. For example, here is a graph of the U.S. dollar from the time that the Federal Reserve was created in 1913.

The U.S. Dollar has lost 97.5% of its purchasing power since the Federal Reserve was created. Everybody is trying to figure out how to maintain their purchasing power. Currency debasement is theft pure and simple. Debt. It is the only path to wealth if you listen to any establishment economist. Yet, the problem with debt is that it has to be repaid. If it is not repaid, it is defaulted on, and the fiat Ponzi scheme gets to begin from scratch all over again.

Don’t ever expect the game to change until citizens become aware that the monetary authorities do not have your best interests at heart. These institutions hoard the gold and issue all of the paper currency thereby acquiring all of the value for themselves. All you need to do is start to price things in terms of Gold and you will begin to understand how toxic fiat currency is to your own survival and chances of acquiring real wealth.

The inflation is rising, and we need to understand what steps we can take to increase our chances of inflation survival.

In 1913 the average home cost $3,000. This represented 150 ounces of Gold. Today the average home in the United States costs about $300,000. The increase in terms of FIAT currency is exponential and is a 9,000% increase in price. But now simply price the same 150 ounces of gold at $1800 an ounce and you will discover that they can still purchase the average home in the United States. In other words, the loss of purchasing power occurs only when you use fiat currencies.

Apply this exercise towards any good or asset and you will discover the same conclusion. FIAT in and of itself will never protect your purchasing power.

Here is another example, on August 15, 1971, President Richard Nixon shut the gold window and removed the U.S. dollar from gold convertibility. On that day, the Dow Jones Industrial Average was trading at 856. Today it is trading at 32,396. This represents a heft 3,684% increase over a period of 51 years.

Gold versus Dow Jones Industrial Index

Sounds impressive, doesn’t it? Until you do the same calculation in terms of Gold. On August 15, 1971, Gold was trading at $35 an ounce. Today it is trading at $1773 an ounce. That represents an increase of 4,966% or 1,281 MORE than the increase in the Dow Jones Industrial Average!

My history teacher taught me that to understand history it all depends on where you start and end your analysis. Often times you will see comparisons of stocks to Gold over very short periods of time to prove that one asset is better than the other. That type of analysis is cherry picking at its finest. It is pure nonsense. For any analysis between two assets to be useful and meaningful you have to have a lengthy and meaningful time frame as a basis of comparison. I think you would agree that using a 50+ year analysis of Gold provides a very practical framework for determining comparative value.

The purpose of this website is to assist individuals who are interested in protecting their purchasing power from the toxic effects of fiat debasement. We look at all of the alternative investment possibilities and have concluded that the solution lies in buying Gold, Silver, and a mere handful of cryptocurrencies.

The best advice that we can provide at this time is that you have to change the way you think about wealth. If you are pricing wealth in terms of a fiat currency it will always be a moving target. But if you price wealth in terms of something that is a genuine store of value, you will have a much easier time of understanding all of the shenanigans that monetary authorities engage in to confuse citizens from understanding what wealth is and how it is protected. Our suggestion is to start pricing your net worth in terms of ounces of gold. Over the longer term this will be a much safer and prosperous means of maintain the value of your savings.

Investing in gold is one of the solid ways to protect your retirement account. The good thing is you don’t need to have a pile of cash to invest in gold. 401K or average IRA is all you need to get started.