Gold Solutions and Cryptocurrency

Investments

You will only understand history when you comprehend how it is directly related to purchasing power.

*Disclosure: We review products independently, but we may earn affiliate commission from buying links on this site.*

Study the history of any group of people or nation states and you will come to understand that the future is often dictated by the purchasing power of their money.

Today it is no different..

Take a look at the following graphic which represents the last 5 Emperors of the United States Monetary system.

Do you think these individuals have your best interests at heart?

Let’s do some purchasing power math.

Emperor #1, Paul Volcker assumed the Chairmanship of the Federal Reserve in August of 1979.

$100 in 1979 is equivalent in purchasing power to about $408.14 today, an increase of $308.14 over 43 years. This means that you need $408.14 today to purchase what $100 purchased when Mr. Volcker assumed the position of Fed Chair.

The dollar had an average inflation rate of 3.32% per year between 1979 and today, producing a cumulative price increase of 308.14%.

This means that today’s prices are 4.08 times higher than average prices since 1979, according to the Bureau of Labor Statistics consumer price index. A dollar today only buys 24.501% of what it could buy back then.

Stated another way, since Paul Volcker assumed his position as Chairman of the Federal Reserve 53 years ago, the U.S. Dollar has lost 75.49% of its purchasing power.

With this kind of track record where do you think we go moving forward?

The bottom line is that currency debasement is always the flavor of the day for the monetary authorities.

In 2021, the current Chairman of the Federal Reserve, Jerome Powell made the following statement at a press conference:

“Many consider it counterintuitive that the Fed would want to push up inflation. However, inflation that is persistently too low can pose serious risks to the economy.”

When a nation’s top banker informs you that they have to increase the pace of currency debasement, my suggestion is that you better start paying attention.

Currency debasement is as old as you can possibly imagine. Not 1 in 100 people can notice it or detect it. That is how effective these Central Bankers are at their jobs.

Let me explain:

In 1960 a simple loaf of bread cost twenty cents (two dimes). Coinage in the United States pre-1964 was silver.

Today that same loaf of bread costs roughly $4.00 which represents 1,900% increase in price.

The Political people should be screaming for the heads of all of the bread manufacturers at this point. How is it that bread prices have gone up this much and we have not passed laws against these price increases?:

But here is the difference. Those two pre-1964 dimes were made of 90% silver which at current prices each dime is roughly worth a minimum of $2.40 at Silvers market value. The two dimes would be worth $4.80 which means you could buy that $4.00 loaf of bread and get change back. In other words, your standard of living actually increased had you chosen or been permitted to transact in Silver.

Which would you rather experience an increase in your standard of living, or a 1900% increase in prices because the currency was debased?

Central Bankers are engaged in all kinds of shenanigans to make you not discover this simple truth. People make more money today that they did in the 1960’s, but their purchasing power if being diluted faster than any increase in salary, they can create for themselves.

Here is the bottom line that you need to be aware of.

Any time that technology is introduced into an economy or business it always results in greater productivity at a lesser cost. Business owners introduce technology into their business to be able to produce more at a lesser cost. This simple reality is what creates a higher standard of living for everyone.

But here is the real head-scratcher.

Why then does the price of goods and services keep going up in price?

The answer is that the currency that you are using to keep score, is being debased faster than technology is reducing cost.

Welcome to the rat race. Where as long as you trust the guidance of the monetary authorities you will always be chasing huge inflationary price increases.

In reality, often times the price increases are quite gradual.

But let me ask you a question.

If I break into your house every year and steal 3.32% of your wealth, am I a thief?

You have to answer that question for yourself and plan your finances accordingly.

Government officials and monetary authorities will never admit that in a strong and prosperous economy where the money is honest, prices of goods and services should ALWAYS decline in relation the strength of the currency that people are transacting in.

One solution is to invest in assets such as gold or silver, which have historically been a store of value. But these investments are always maligned by financial planners and monetary authorities.

Another solution is to educate yourself on the blockchain and cryptocurrencies. 99% of all cryptocurrencies are junk and will not survive. But there are a few very promising cryptocurrencies that can protect your purchasing power from persistent debasement.

“it is no crime to be ignorant of economics, which is after all, a specialized discipline and one that most people consider to be a ‘dismal science.’ But it is totally irresponsible to have a loud and vociferous opinion on economic subjects while remaining in this state of ignorance.” – Murray Rothbard

Our purpose at InflationSurvivor.com is to offer educational resources on how people can best protect their purchasing power in a world of economic chicanery.

Why Gold is much needed alternative investment for your portfolio

If you talk to any mainstream financial planner, you will quickly discover that gold is a contradiction and paradox. Mainstream people will often refer to gold as a barbarous relic. They often disparage the metal as simply being a rock.

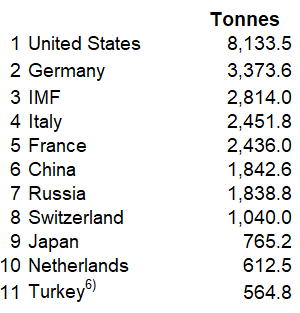

But here is where we would challenge you to think for yourself and simply evaluate some key facts and figures. The following table is a listing of the largest nations’ central banks in the world and how much gold they actually hold. As you review this list, please keep in mind that these institutions are the leading hoarders of gold. Yet in spite of the fact that they hold thousands of tons of the precious metal, and they buy enormous quantities of the precious metal every year, they never miss an opportunity to promote paper currencies and disparage gold. It is truly one of the most entertaining shows on planet earth.

The very institutions which chastise the yellow metal continue to purchase record quantities of it every year.

The very institutions which chastise the yellow metal continue to purchase record quantities of it every year.

These same central banks control the monetary printing press. They print billions or trillions of new money every year and make it mandatory for their paper money (fiat) to be accepted as payments for all transactions public and private.

Fiat currency is a currency that is not backed by a physical commodity, such as gold or silver, but rather by the faith and credit of the government.

Fiat currencies are also often referred to as paper money or debased coinage. The fiat currency system was first introduced in medieval China, and later spread to other parts of the world. The primary advantage of fiat currency is that it can be easily created, which allows governments to print money when needed. However, this ease of creation can also lead to problems, such as inflation or hyperinflation.

More importantly, the track record of fiat currencies is almost 100% failure. As difficult as that fact is to believe all fiat currencies fail. The average lifespan of a fiat currency is roughly 50 years. There are small exceptions to this rule, but the reality is that all paper currencies are traditionally debased until they lose all of their value.

For example, the British Pound Sterling is the oldest fiat currency. It was founded in 1694. Even though it has survived 328 years, it has lost 99.5% of its original purchasing power. Originally, the British Pound was defined as 12 ounces of silver which would be worth roughly $240 today. The current price on the foreign exchange markets for British Pound Sterling is $1.22. That represents a debasement of 99.492%.

Defenders of this practice are supporters of big government who believe that this debasement was necessary because the government was promoting the “greater good.” My suggestion is to do your own research and draw your own conclusions. Whenever you study monetary history, the story is always the same. The monetary authorities debase the currency to pay for the debts of the kingdom and then they only have two choices:

- Make the citizens pay the bill. Or,

- Debase the currency by inflating the amount of currency in circulation.

Solution #1 causes revolutions so the only politically feasible solution is currency debasement.

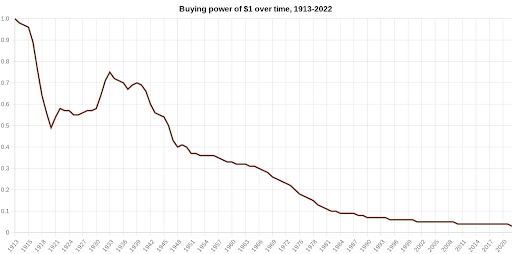

You will find this footprint across all countries which adopt a fiat currency. For example, here is a graph of the U.S. dollar from the time that the Federal Reserve was created in 1913.

The U.S. Dollar has lost 97.5% of its purchasing power since the Federal Reserve was created.

The U.S. Dollar has lost 97.5% of its purchasing power since the Federal Reserve was created.

Everybody is trying to figure out how to maintain their purchasing power. Currency debasement is theft pure and simple. Debt. It is the only path to wealth if you listen to any establishment economist. Yet, the problem with debt is that it has to be repaid. If it is not repaid, it is defaulted on, and the fiat Ponzi scheme gets to begin from scratch all over again.

Don’t ever expect the game to change until citizens become aware that the monetary authorities do not have your best interests at heart. These institutions hoard the gold and issue all of the paper currency thereby acquiring all of the value for themselves. All you need to do is start to price things in terms of Gold and you will begin to understand how toxic fiat currency is to your own survival and chances of acquiring real wealth.

In 1913 the average home cost $3,000. This represented 150 ounces of Gold. Today the average home in the United States costs about $300,000. The increase in terms of FIAT currency is exponential and is a 9,000% increase in price. But now simply price the same 150 ounces of gold at $1800 an ounce and you will discover that they can still purchase the average home in the United States. In other words, the loss of purchasing power occurs only when you use fiat currencies.

Apply this exercise towards any good or asset and you will discover the same conclusion. FIAT in and of itself will never protect your purchasing power.

Here is another example, on August 15, 1971, President Richard Nixon shut the gold window and removed the U.S. dollar from gold convertibility. On that day, the Dow Jones Industrial Average was trading at 856. Today it is trading at 32,396. This represents a heft 3,684% increase over a period of 51 years.

Sounds impressive, doesn’t it? Until you do the same calculation in terms of Gold. On August 15, 1971, Gold was trading at $35 an ounce. Today it is trading at $1773 an ounce. That represents an increase of 4,966% or 1,281 MORE than the increase in the Dow Jones Industrial Average!

My history teacher taught me that to understand history it all depends on where you start and end your analysis. Often times you will see comparisons of stocks to Gold over very short periods of time to prove that one asset is better than the other. That type of analysis is cherry picking at its finest. It is pure nonsense. For any analysis between two assets to be useful and meaningful you have to have a lengthy and meaningful time frame as a basis of comparison. I think you would agree that using a 50+ year analysis of Gold provides a very practical framework for determining comparative value.

The purpose of this website is to assist individuals who are interested in protecting their purchasing power from the toxic effects of fiat debasement. We look at all of the alternative investment possibilities and have concluded that the solution lies in Gold, Silver, and a mere handful of cryptocurrencies.

The best advice that we can provide at this time is that you have to change the way you think about wealth. If you are pricing wealth in terms of a fiat currency it will always be a moving target. But if you price wealth in terms of something that is a genuine store of value, you will have a much easier time of understanding all of the shenanigans that monetary authorities engage in to confuse citizens from understanding what wealth is and how it is protected. Our suggestion is to start pricing your net worth in terms of ounces of gold. Over the longer term this will be a much safer and prosperous means of maintain the value of your savings.

Top 6 Gold IRA Investment Companies | Top 6 IRA Reviews for 2022

All of our top 6 gold IRA companies enjoy perfect or near-perfect ratings from reliable consumer rating services as well as hundreds of five-star reviews from enthusiastic clients.

American Hartford Gold

So, although you can’t go wrong among these winning companies, consider how each may fit your specific needs and values. Here is a brief comparison of the best gold IRA services, with our in-depth reviews following:

1st: American Hartford – Best for Preppers and Independent Lifestyle

- Pros:

- Low $5000 entry, one of the Lowest in the Industry!

- Buyback commitment

- Products are available from U.S., Canada, Australia, Switzerland, Austria and South Africa

- Price match guarantee

- The only gold investment company recommended by Bill O’Reilly, Rick Harrison and Lou Dobbs.

- Cons: Limited inventory compared to other companies that sell international coins

- Slightly higher fees than other competitors.

2nd: Birch Gold – Best for Recent Retirees and “FIRE Retirees”

- Pros:

- A+ rating Better Business Bureau

- Offer Free Shipping on All Orders

- No Fees on the first year on transfers over $50,000

- Hard asset IRA availability

- Great Friendly Customer Service 1-on-1 care

3d: Noble Gold Group – Best for Entrepreneurs and Early Retirees

- Pros:

- Quick, Fast efficient signup process

- Low Annual Fees

- A+ Better Business Bureau Rating

- Transparent Fee structure

- Available not only in US, but in Canada as well

- Large variety of coins to choose from

- Fast secure home delivery options for bullion

- Cons: Younger company; Not available to international customers (other than Canada)

4th: Advantage Gold – Best for Beginners to Start and Grow a Portfolio

- Pros:

- They specialize on helping first-time precious metals investors

- Official U.S. Mint dealer, so you can be confident in the authenticity of your purchases

- Patient customer service that answers all your questions fully and transparently

- Fast cash-out process (sometimes less than 24 hours)

- Cons: No online interface for the account set-up (has to be over-the phone); Newer company (2014)

Top Crypto Companies Help You to Diversify Your Investment Portfolio

Cryptocurrencies are becoming more and more popular every day. As the value of Bitcoin and other digital currencies continues to rise, more and more people are looking to invest in them. If you’re looking for a way to diversify your investment portfolio, consider investing in cryptocurrencies. In this article, we will discuss some of the top crypto companies that can help you get started!

What Are Cryptocurrencies? Why Are They Becoming More Popular

Cryptography is used by cryptocurrencies, which are digital or virtual tokens, to safeguard their transactions and regulate the generation of new units. Cryptocurrencies are decentralized, which means that neither the government nor financial institutions have any influence over them. In 2009, the first and most well-known cryptocurrency, Bitcoin, was developed. Cryptocurrencies can be used to pay for products and services as well as be traded on decentralized exchanges.

Cryptocurrencies have become increasingly popular due to their unique features and potential benefits. For example, cryptocurrencies can be used to send and receive payments anywhere in the world quickly and cheaply. Cryptocurrencies are also pseudo-anonymous, meaning transactions can be made without revealing the identity of the parties involved.

In addition, cryptocurrencies are often seen as a store of value and a hedge against inflation. As a result, many investors have started to include cryptocurrencies in their investment portfolios in order to diversify their holdings and reduce their overall risk.

The Top Five Crypto Companies and What They Offer

When it comes to investing, diversification is key. By spreading your money across different investments, you can minimize risk and maximize returns. And while stocks and bonds have long been the traditional foundation of a diversified portfolio, more and more investors are turning to cryptocurrencies as a way to further mitigate risk. Here are five of the top blockchain companies that can help you do just that:

⦁ Coinbase: Coinbase is one of the famous cryptocurrency exchanges, Coinbase offers an extensive range of digital assets, including Bitcoin, Ethereum, Litecoin, and more. Coinbase as a blockchain custom software development company is also one of the most user-friendly exchanges, making it a great choice for investors who are new to the blockchain platforms.

⦁ Binance: Binance is another popular cryptocurrency exchange that offers a wide selection of digital assets. In addition to major coins like Bitcoin and Ethereum, Binance also supports a number of altcoins, which can offer greater upside potential in a bullish market.

⦁ Kraken: Kraken is a blockchain company that leads the exchanges for margin trading cryptocurrencies. Margin trading allows investors to trade with leverage, which can amplify both profits and losses. As such, margin trading is only suitable for experienced investors who are comfortable with managing increased risk.

⦁ Bitfinex: Bitfinex is another popular exchange for margin trading cryptocurrencies. In addition to offering leverage on trades, Bitfinex also allows investors to borrow funds from other users on the blockchain platform in order to trade with even more leverage for blockchain solutions. Again, this increases risk but can also lead to larger profits in a bullish market.

⦁ OKEx: OKEx is a major cryptocurrency derivatives exchange that offers futures smart contracts on a variety of digital assets. Futures contracts allow investors to trade on the future price of an asset, giving them the ability to make profits (or losses) regardless of the current market direction in a blockchain ecosystem.

How to Invest in Cryptocurrencies

Investing in cryptocurrencies is a risky endeavor, but it can be potentially lucrative. Here are a few tips for investing in cryptocurrencies:

⦁ Research the market thoroughly with the help of blockchain consulting services before investing any money. Cryptocurrencies are highly volatile, so it’s important to understand the risks before putting any money into the market.

⦁ Only invest money that you can afford to lose. Cryptocurrencies are a risky investment, so it’s important to only invest money that you’re comfortable losing in the blockchain industry.

⦁ Diversify your portfolio. Don’t put all your eggs in one basket – diversify your portfolio by investing in a variety of different crypto assets. This will help to mitigate your risk if the value of one particular currency plummets.

⦁ Be prepared for volatility. The value of cryptocurrencies can fluctuate wildly, so it’s important to be prepared for both ups and downs. Don’t invest more money than you’re comfortable losing and remember that the value of your investment could go to zero overnight.

⦁ Have a long-term outlook. Cryptocurrencies are long-term investments, so it’s important to have a long-term outlook when investing in them. Don’t expect to get rich quickly – instead, focus on holding your investment for the long haul.

By following these tips, you can minimize your risk and maximize your potential for profit with these blockchain development services.

The Benefits of Diversifying Your Investment Portfolio with Cryptos

When it comes to investing, there is no one-size-fits-all approach. However, one principle that all investors should follow is diversification. By spreading your investment across different asset classes, you can minimize the risk of loss while still providing yourself with the opportunity to generate returns with blockchain technology.

One asset class that is often overlooked is cryptocurrency. Cryptocurrencies offer a high degree of volatility, which can be both a blessing and a curse. However, for investors who are willing to stomach the ups and downs, cryptocurrencies can provide an excellent way to diversify their portfolios.

In addition to offering the potential for high returns, cryptos are also relatively uncorrelated with other asset classes, which means that they can help to hedge your portfolio against market fluctuations. For these reasons, diversifying your investment portfolio with cryptos is a smart move that can help you reach your financial goals.

How to Stay Safe When Investing in Cryptos

As an investor, you always want to diversify your portfolio to reduce risk. And with the recent volatility in the stock market, you may be looking for alternative investments that can help you weather the storm. Cryptocurrencies have been one of the hottest asset classes in recent years, and they offer the potential for high returns. But they also come with a unique set of risks. Here are a few tips to help you stay safe when investing in cryptos.

First, only invest what you can afford to lose. Cryptocurrencies are a highly speculative asset class, and Prices can swing wildly from day to day. If you’re not prepared to lose all of your investment, then it’s best to stay on the sidelines.

Second, don’t put all your eggs in one basket. There are thousands of different cryptocurrencies out there, and new ones are being created all the time. Spread your investments around to diversify your risk.

Third, do your own research before investing. There are a lot of scams and bad actors in the crypto space. Don’t take someone’s word for it that a particular coin is going to make you rich quickly. Do your own due diligence before investing any money.

Fourth, use a reputable exchange or wallet provider. There have been several high-profile hacks of exchanges and wallets in recent years. So, make sure you’re using a reputable provider that has a strong security protocol in place with regards to the blockchain system.

Following these tips will help you stay safe when investing in cryptos. But remember that there’s always risk involved in any investment, so don’t put more money into cryptos than you can afford to lose.

Types of crypto investments

- A-list cryptocurrencies within Top 10 crypto by market cap

- B-list cryptos and altcoins within top 100 crypto by market cap

- NFTs

- Crypto real estate

- Crypto games

- Crypto utility projects

- DAOs