Are you asking yourself: ” How do I convert my 401k to gold and silver?” or “Can I move my 401k to Gold”?

Maybe you are interested in learning more about how to roll over a 401k into a Gold Ira? If so, you have come to the right place! In this blog post, we will walk you through the process step by step. We will also provide information about the benefits of a Gold IRA Rollover, as well as answer some common questions about the rollover process. By following our 401k to gold rollover guide, you can make the transition from a 401k to a Gold Ira as smooth and stress-free as possible!

What Is a Gold Ira Rollover and How Does It Work?

A gold IRA rollover is a type of Individual Retirement Account that allows the account holder to invest in physical gold, silver, and other physical precious metals IRA. Unlike a traditional IRA and Roth IRA, which are typically invested in stocks and bonds, a gold IRA gives investors the opportunity to diversify their portfolio with hard assets. While there are many benefits to investing in gold and Augusta precious metals, the most appealing aspect of a gold IRA rollover is the ability to protect your retirement savings from inflation.

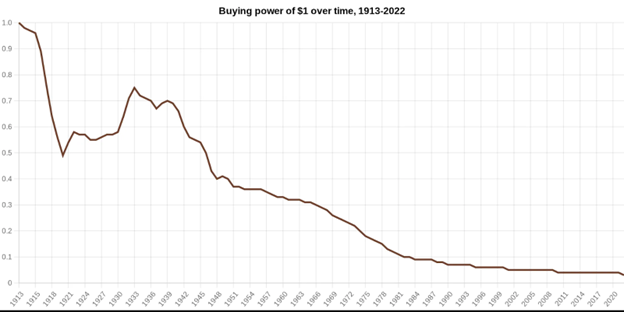

Over time, the purchasing power of paper currency tends to decline as inflationary pressures increase. The following graphic shows the purchasing power of $1 from 1913 to present time. You can see that the greenback has lost 97% of its purchasing power in this time frame.  By contrast, gold tends to retain its value, or even increase in value, during periods of inflation. As a result, investing in gold can help to ensure that your retirement savings will be able to keep pace with the cost of living. If you’re thinking about rolling over your traditional IRA into a gold IRA, it’s important to work with an experienced gold IRA custodian who can help you navigate the process. The custodian is the legal entity that stores the gold is an approved depository.

By contrast, gold tends to retain its value, or even increase in value, during periods of inflation. As a result, investing in gold can help to ensure that your retirement savings will be able to keep pace with the cost of living. If you’re thinking about rolling over your traditional IRA into a gold IRA, it’s important to work with an experienced gold IRA custodian who can help you navigate the process. The custodian is the legal entity that stores the gold is an approved depository.

The Benefits of a Gold IRA Rollover

There are several benefits to investing in gold through a Gold IRA Rollover. First, gold provides a hedge against inflation. Over time, the power of purchasing precious metals and gold tends to increase, while the purchasing power of other assets like cash declines. This means that gold and other precious metals can help preserve the value of your retirement savings. Second, gold is a relatively stable investment. This stability can provide peace of mind for retirees who are worried about the ups and downs of the stock market.

Finally, gold is easy to trade and can be converted into cash quickly if needed. This makes it a convenient investment for those who want the flexibility to access their money when they need it. Investing in gold through a Gold IRA Rollover can help you preserve your wealth, protect your retirement savings from market volatility, and provide peace of mind throughout your golden years.

How To Rollover a 401k Into a Gold IRA: A Step-by-Step Guide

Based upon all of the madness that is occuring in the world, more and more people are looking for ways to diversify their retirement portfolios and protect their purchasing power. One popular option is to roll over a 401k into a Gold IRA. Here is a step-by-step guide on how to do this:

1) The first step is to contact your current 401k gold IRA provider and let them know that you want to roll over your account into a Gold IRA. They will need your account information and may require you to fill out some paperwork. Click this link to discover our preferred gold ira rollover providers.

2) Once you have contacted your 401k provider, you will need to open a Gold IRA account with a trustee. This can be done through a financial institution or a gold dealer.

3) Once you have opened your Gold IRA account, you will need to transfer the assets from your 401k into the new account. This can be done through a direct transfer or by setting up a 60-day rollover.

4) After the assets have been transferred into your Gold IRA, you will need to decide how you want to invest the money. You can choose to invest in gold coins, bars, or ETFs.

5) Once you have made your investment choices, you will need to hold onto the assets for at least five years before you are able to withdraw them without paying any penalties. By following these steps, you can roll over your 401k into a Gold IRA and diversify your retirement portfolio. This can help protect your assets from inflation and market volatility.

Things You Need to Know Before You Roll Over Your 401k

The 401k is one of the most popular retirement savings plans in the United States. If you have a 401k through your employer, you may be considering rolling it over into a gold IRA. There are a few things you need to know before you make this decision. First, 401k plans typically have high fees and long vesting periods. This means that it can take years for you to actually gain full ownership of the assets in your 401k. By rolling over into a gold IRA, you can avoid these fees and own your assets outright. Second, 401k plans are often subject to estate taxes. This means that if you die before reaching retirement age, your heirs may have to pay taxes on the 401k assets. With a gold IRA, there is no estate tax liability. Third, 401k assets are also subject to income taxes. This means that if you withdraw money from your 401k before retirement age, you will have to pay taxes on the withdrawal. With a gold IRA, you can take distributions without having to pay any income taxes. Fourth, 401k plans often have limited investment options.

This can make it difficult to find the right mix of investments for your portfolio. With a gold IRA, you have a wide range of investment options available to you. The fifth and final thing you should know is that gold IRA rollovers are not always easy to do. You will need to find a reputable gold IRA company that specializes in rollovers and transfer your assets into the new account.

The process can be complicated and time-consuming, so make sure you do your research before making any decisions. Because there are a few things you need to know before rolling over your 401k into a gold IRA, we’ve put together this helpful guide. In it, we’ll walk you through the process step-by-step so that you can make an informed decision about what’s best for your retirement savings.

If you decided to Rollover Your 401k or IRA (whether it’s a traditional, Roth, SEP, or SIMPLE), you might want to take advantage of the bonuses offered by some of the Gold IRA companies. Check them out:

Important Deadlines to Remember When Rolling Over Your 401k

There are a few important deadlines to remember when rolling over your 401k. First, you have 60 days from the date you receive the distribution to roll it over to another eligible retirement account. If you don’t roll it over within that timeframe, the distribution will be considered a withdrawal and you’ll be subject to income taxes and possibly a 10% early withdrawal penalty. Second, if you’re still employed by the companies that sponsor your 401k plan, you generally can’t roll it over until you leave your job. And finally, once you do roll over your 401k, you generally can’t redeposit the funds back into the original 401k plan.

If you withdraw your metals early, you may be subject to unnecessary taxes. Therefore, it’s important to plan your distributions carefully. Our advice is simple and practical: when in doubt find out. Your custodian is there specifically to answer all of your questions and provide education of how a gold ira rollover will affect you personally. This educational and advisory resource is invaluable and provides tremendous peace of mind to those seeking tax advantage precious metals investing. By understanding the tax implications of investing in precious metals, you can help ensure that your investment portfolio is as efficient as possible.