Inflation and Money Supply

“Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” – Milton Friedman, Nobel Memorial Prize in Economics – 1976

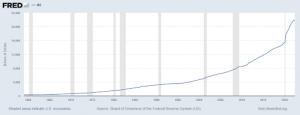

Over the last 5 years, Money Supply growth as measured by M2 has grown by 58%. What this means is that 58% of new money has been added to the economy. The new money was added by monetary authorities to stimulate economic growth. The problem with this concept is that the money which does not produce new wealth in terms of infrastructure for goods and services, ends up diluting your purchasing power and results in requiring you to use more units of currency to purchase the same things. (This is inflation.)

The money supply is the total amount of cash and coin in circulation, as well as the balances in checking and savings accounts. It is important to note that the money supply does not include investments such as stocks or bonds. The purpose of the money supply is to provide a measure of the liquidity of an economy. In other words, it is a way to gauge how much cash and coin are available to be used for transaction purposes.

It was only a few years ago that these same monetary authorities told us:

- Inflation would not occur.

- It was necessary to hit a 2% inflation target.

- It would only be “transitory.”

Be forewarned when you add 58% new money to an economy in such a short time frame you are playing with monetary fire.

Gold prices have rallied over the longer term but have been consolidating their gains, and this is likely to continue in the coming years. As inflation continues to creep up, gold will become an even more valuable commodity. This is why it is important for investors to start thinking about converting their IRA or 401k into a gold-based investment. Gold IRA investment companies can help you do this in a safe and secure way. In this blog post, we will discuss how these companies can help you survive inflation and protect your retirement savings!

What Is Inflation and How It Can Affect You

Inflation is the devaluation of a currency over time. When inflation goes up, each dollar you have buys less and less. This is why it’s important to invest in something that will hold its value or even increase in value as inflation goes up.

Precious metals IRA, such as physical gold, have historically been some of the best investments to protect against inflation. Gold is a physical asset that can’t be printed or created out of thin air like fiat currency. This rarity makes it much more resistant to inflation.

Gold IRA companies can help you take advantage of this by rolling over your traditional IRA into a gold IRA. This will give you the ability to invest in gold bullion and other precious metals, which can help you survive and even thrive during periods of high inflation.

How To Protect Your Money from the Inflation

In today’s economy, it’s more important than ever to find ways to protect your money from inflation. One way to do this is to invest in gold. Gold is a valuable commodity that has been used as a form of currency for centuries. Unlike paper money, gold is not subject to the same forces of inflation. As the price of gold goes up, the purchasing power of your money remains the same. This makes gold an ideal minimum investment for those looking to protect their savings from inflation.

There are a few different ways to invest in gold. One option is to purchase gold and coins or bars. Another option is a gold IRA investing. Gold IRA investment companies can help you set up an account and make contributions on your behalf. They can also provide guidance on how to best allocate your assets in order to maximize your return on investment.

If you’re concerned about inflation and want to find ways to protect your money, investing in gold is a smart choice. Gold IRA investment companies can help you get started and ensure that your investment is properly managed.

The Different Types of Gold IRA Investment Companies

There are a few different types of best gold IRA companies. The most common type is the custodian, which holds and protects your assets. Another type is the dealer, which buys and sells gold on your behalf. A third type is a refinery, which melts and analyzes your gold to purity levels. Finally, there are companies that focus on value-added services like secure storage and transportation.

Each type of company has its own strengths and weaknesses, so it’s important to do your research before choosing one. The most important thing is to find a reputable company that you can trust with your investment.

Why Invest in a Gold IRA Company

There are many reasons to invest in a reputable gold IRA company. One of the biggest reasons is that gold is a stable investment. Unlike stocks and bonds, gold does not fluctuate in value as much. This means that you can rest assured knowing that your investment is not going to lose a lot of money if the market crashes. Gold is also a good way to diversify your portfolio. This means that if one investment goes down, you have others to fall back on.

Additionally, gold has historically been a good investment. Over time, it has gone up in value, meaning that you can make a lot of money if you invest early and hold onto your gold for a long period of time.

Overall, investing in gold is a smart choice for anyone who is looking to stable their financial future.

How To Choose a Good Gold IRA Investment Company

There are a few things to keep in mind when choosing a gold IRA investments company.

First, make sure the company is reputable and has a good track record. There are many gold investment companies that claim to be experts in gold investing, but not all of them are created equal. Do your research and only work with a company that has a solid reputation.

Second, make sure the company offers a diversified selection of gold IRA products. You don’t want all of your eggs in one basket, so it’s important to have a variety of options to choose from. A good company will offer a mix of gold coins, bars, and bullion, as well as other types of investments like precious metals IRA ETFs.

Finally, make sure the gold investment company you choose has competitive fees. Look for a company that charges reasonable fees for their services and doesn’t try to nickel-and-dime you with excessive charges. By doing your homework and shopping around, you can find the best gold IRA company and business consumer alliance that meets all of your needs and can be your gold ira custodian.

Things You Need to Know Before Investing in a Gold Ira Company

Before investing in a premier gold IRA company, there are several things you need to know.

First, you need to understand how a traditional IRA is different from Roth IRA. With a traditional IRA, you make contributions with pre-tax dollars and you pay taxes on withdrawals in retirement. With a Roth IRA, you make contributions with after-tax dollars and your withdrawals are tax-free in retirement.

Second, you need to know how to contribute gold to your IRA. The IRS requires you to find a custodian that offers true self-directed IRA and purchase only those products that meet the requirement of 99.9% fineness or higher.

Finally, you need to research different gold IRA companies to find one that is reputable and has low fees. By doing your homework before investing, you can help ensure that your gold IRA accounts are a wise investment.

Bonuses for 401k to Gold IRA Account Signup

Some gold IRA companies, not all of them, offer bonuses for 401k/IRA to gold IRA rollover accounts.

Keep in mind the company that offers the signup bonuses might not be necessarily the right fit for you.

But if Free Silver Bonus interests you as a bonus when converting your 401k to gold, then click this button to